Modern life runs on subscriptions. From streaming and music platforms to fitness apps and meal kits, convenience now comes in recurring monthly charges. While each one may seem harmless on its own, their cumulative effect can quietly strain your finances. Economists call this phenomenon subscription creep — the gradual buildup of small, automatic expenses that reduce disposable income over time. Understanding how it happens — and how to counter it — can make the difference between steady savings and constant shortfall.

1. The Hidden Cost of Convenience

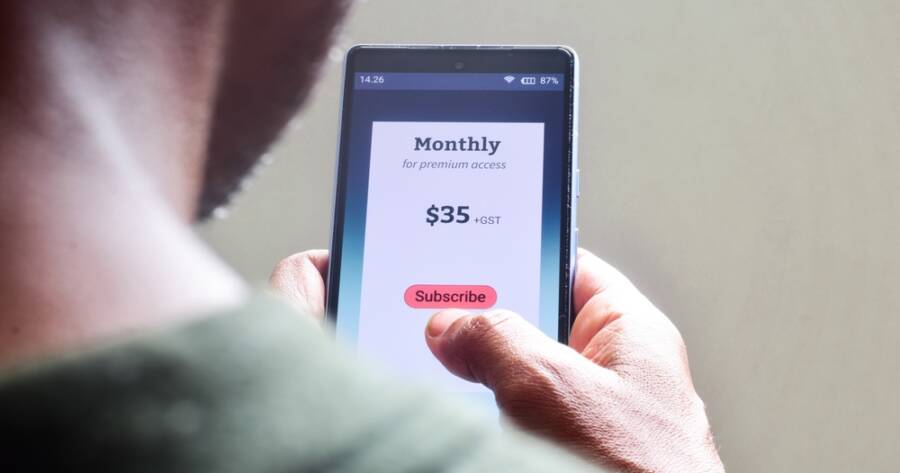

Subscription-based business models have exploded because they align perfectly with consumer psychology. Paying a small recurring fee feels painless compared to one large upfront cost. Companies know this — and they’ve mastered the art of making recurring payments invisible.

Once you sign up, most subscriptions renew automatically, rarely drawing attention unless you actively check your bank statement. This creates what behavioral economists call payment friction reduction — the less effort it takes to pay, the less likely you are to question the value. Over time, these seamless systems create financial leakage that can go unnoticed for months or even years.

The danger isn’t in one subscription — it’s in the accumulation. Ten small services at $10 or $15 each quickly add up to hundreds of dollars a year. The convenience that initially made life easier begins to erode long-term financial flexibility.

2. Why Subscription Creep Is So Effective

Subscription creep thrives on a mix of behavioral biases that shape human decision-making. The first is anchoring — the tendency to focus on the initial price while ignoring the cumulative cost. A $9.99 fee seems minor until it multiplies across multiple services.

Another bias at play is loss aversion. Once we adopt a subscription, canceling it feels like giving something up, even if we rarely use it. Companies exploit this by framing cancellation as a loss of benefits rather than a savings opportunity.

Finally, present bias — our preference for immediate gratification over long-term reward — encourages signing up for trials or temporary perks. No-fee periods or low introductory rates make us focus on short-term enjoyment while ignoring future costs. Once the trial ends, inertia takes over, and the payment continues by default.

In short, subscription creep works because it’s designed to bypass conscious financial decisions. The system runs automatically — and so does the spending.

3. The Macro Impact on Personal Budgets

Individually, a few extra subscriptions might not seem catastrophic. But at scale, they can reshape personal and even national spending patterns. Consumer data in the U.S. shows that recurring digital services now make up a significant share of household discretionary spending. As more products shift to subscription models — from car features to software and groceries — the boundary between “need” and “nice-to-have” blurs.

This slow reclassification of everyday expenses changes how people perceive value. Instead of owning items outright, consumers rent access indefinitely. While this can make high-quality goods more accessible in the short term, it also removes the satisfaction of completion. There’s no end point — only perpetual renewal.

The result is subtle but powerful: less liquidity, less savings potential, and more dependence on continuous income. Subscription creep doesn’t just drain money — it rewires financial psychology, normalizing permanent micro-spending as a way of life.

4. Spotting and Controlling Subscription Leakage

Breaking free from subscription creep starts with awareness. Most people underestimate how many recurring payments they have until they see them listed in one place. Many banks and budgeting apps now categorize recurring transactions automatically, making it easier to spot hidden charges.

Once identified, evaluate each subscription by asking three questions:

- Do I use this service regularly?

- Would I notice if it disappeared tomorrow?

- Is there a cheaper or no-fee alternative that offers similar value?

If the answer to any of these is “no,” it may be time to cancel. Some people find success in implementing a “subscription fast” — pausing all nonessential services for 30 days to see which ones they truly miss.

For ongoing subscriptions that you want to keep, align billing dates or set calendar reminders before renewals. This reintroduces conscious decision-making into a system designed for automation. You don’t have to cancel everything — just make sure every recurring charge earns its place in your budget.

5. Shifting from Passive to Active Consumption

The ultimate defense against subscription creep isn’t just cancellation — it’s shifting from passive to active consumption. Instead of letting convenience dictate behavior, reclaim control through deliberate use.

That might mean alternating between services rather than keeping multiple at once — for instance, subscribing to one streaming platform per quarter instead of maintaining several year-round. Or it could mean rotating memberships seasonally, such as pausing fitness apps during outdoor months.

This approach keeps spending flexible without depriving you of variety. It transforms subscriptions from fixed costs into optional tools you can activate as needed.

The Power of Paying Attention

Subscription creep doesn’t happen overnight — it builds quietly, disguised as convenience and comfort. But left unchecked, it can consume hundreds or even thousands of dollars each year, reducing savings and financial freedom.

The solution isn’t to avoid subscriptions altogether but to manage them consciously. When you treat each recurring charge as a choice rather than a default, you regain control over your financial ecosystem. In a world built on auto-renewal, the most powerful economic habit is awareness — because attention, not automation, is what truly protects your wallet.