Finance

Finance

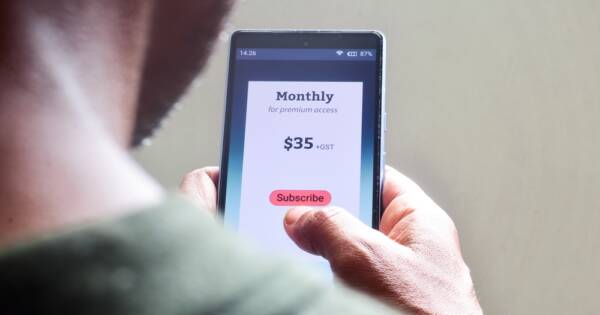

Subscription Creep: How Small Charges Can Erode Your Finances

Modern life runs on subscriptions. From streaming and music platforms to fitness apps and meal kits, convenience now comes in recurring monthly charges. While each one may seem harmless on its own, their cumulative effect can quietly strain your finances. Economists call this phenomenon subscription creep — the gradual buildup of small, automatic expenses that […]

4 minute read